암호화 승리! 🚀🏛️ 요율 삭감 & Pro-Bitco Sec?!

- C C Crypto Market은 콘크리트를 밀어 붙이는 완고한 잡초와 마찬가지로 탄력성을 보였고, 트럼프의 무역 전쟁에서 장기적인 이익을 기대했습니다.

- 비트 코인은 강력하고, 디지털 사모바르는 프로-크립토 감정이 워싱턴에서 오하이오에서 구축되면서 즐겁게 찐다.

연극 적으로 이름이 지정된 “해방 일”관세에 이어, 예측할 수없는 짐승은 주목할만한 변동성, 지정 학적 돌풍과 규제 무기파 사이의 춤을 경험했습니다. 🎭

시가 총액에 의한 지배적 인 자산으로서 Bitcoin [BTC]은 계속 혼란스런 암호화 오케스트라에서 타오르는 트럼펫 인 톤을 계속 설정하고 있습니다. 🎺

Trading at $84,121 at press time, BTC registered a modest 0.65% increase from the previous close. A tiny step for Bitcoin, a slightly larger step for crypto-kind? 🤔

Despite concerns over a potential “market-wide” correction—a phantom menace, perhaps?—the anticipated sell-off, that great decluttering sale, failed to materialize. As a result, the market remains in the green, maintaining its upward trajectory. A stubborn, verdant vine clinging to the facade of the financial world.

What happened in crypto today?

Let’s take a step back, as one does when contemplating the absurd, to analyze the aftermath of the trade war. The Volatility Index (VIX) spiked to an eight-month high, reflecting a surge in market uncertainty and risk appetite. Like a startled cat, the market jumped. 🐈⬛

All three major U.S. stock indices saw massive sell-offs, erasing trillions in market capitalization, with the Magnificent Seven stocks trading 34% below their respective all-time highs. Oh, the hubris! Even the mighty stumble. 🤡

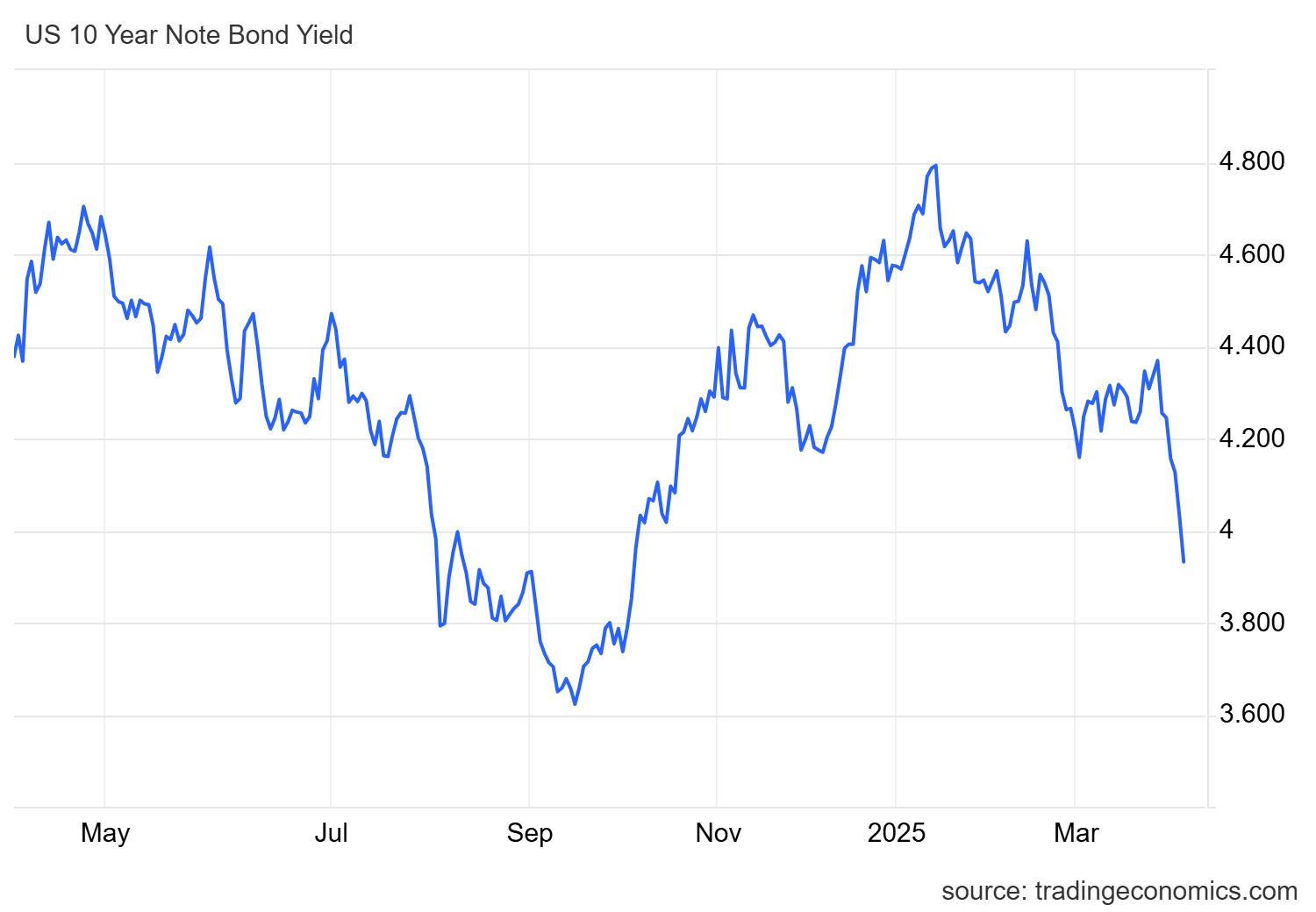

Meanwhile, the 10-year Treasury yield (the interest rate the U.S. government pays to borrow money) retraced to pre-election levels, dropping by -90 basis points (bps). Back to the familiar, or so it seems…

Typically, when yields fall, investors often move money into safe assets like Treasury bonds, anticipating slower economic growth in Q2. Like lemmings to the shore, but with spreadsheets. 🤓

//ambcrypto.com/wp-content/uploads/2025/04/Screenshot-2025-04-04-193433.png”/>

Should these conditions persist, risk appetite may increase, setting the stage for stronger institutional inflows and a potential market-wide rally in the coming quarters. The curtain rises… Will it be a tragedy, a comedy, or simply more of the same? Only time, and the whims of the market, will tell. ⏳

- RARE 가격 예측. RARE 암호화폐

- SOL 가격 예측. SOL 암호화폐

- DOT 가격 예측. DOT 암호화폐

- POKT/USD

- TIA 가격 예측. TIA 암호화폐

- Solana의 가격 패턴 : $$$로 가득 찬 찻잔? 🚀

- 솔라나 드라마 : 인플레이션 삭감, 스트레스 테스트 및 암호화 혼돈! 🚨

- 비트 코인 트레이더 공황 : 끝이 가까워 지나요? 😱

- Solana의 가격이 마지막 관계보다 빠르게 급락합니까? 😱

- 암호화 재앙 : 2025 년에 McGlone의 예측이 지갑에 의미하는 바!

2025-04-05 08:12